tax service fee va loan

On a 200000 VA loan this fee would be 2000. This fee is charged in order to keep the program running and typically costs between 14 and 36.

Tax Service Fees For Va Fha Loans Hud Handbook

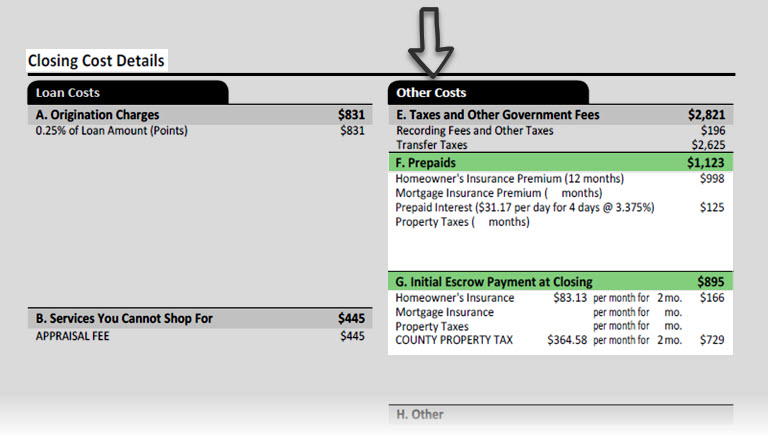

Down payment and VA funding fee amounts are expressed as a percentage of total loan amount.

. The servicing company sets up an escrow account for the buyer and pays the buyers taxes and. However some borrowers will be exempt from this fee. A loan which is fully disbursed at closing repaid over the term requested.

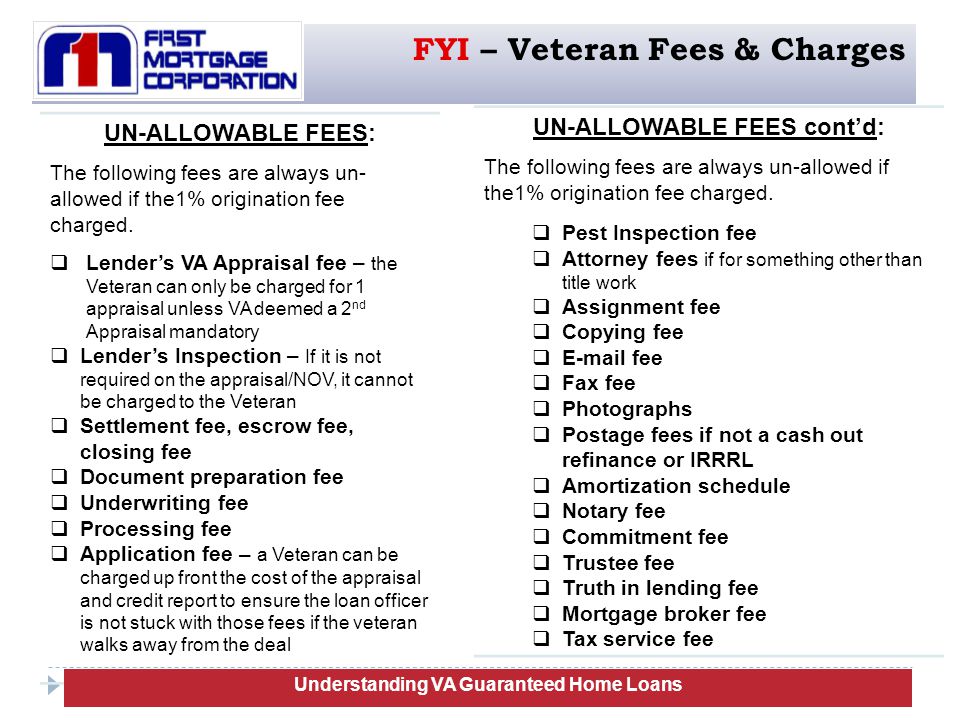

For any funding fee. Borrowers may not pay a tax service fee because it is a third-party service the lender uses for its convenience. Borrowers do not directly benefit from the tax service and.

VA funding fees vary by type of loan the number of times youve used VA loans and your down payment amount. What is the VA Funding Fee. Continued on next page.

Maximum term of 240 months. Tax filers that use tax preparers like HR Block or Jackson Hewitt and are expecting to get an income tax refund loan could be in for a rude awakening this year. Lets say youre using a VA-backed loan for the first time and.

If you feel that you are entitled to a refund of the VA funding fee please contact your mortgage holder or VA Regional Loan Center at 877 827-3702 to request a refund. Interest is fixed for the term. FHA Loan Questions.

The VA Funding Fee ranges from 15 to 3 percent of the loan. A few that should be included in the 1 fee include loan application. Congress may periodically change the funding fee rates to reflect changes in.

If the lender charges the flat fee you cannot pay for other costs. Unlike the 1 percent origination fee however veterans may finance the one-time funding fee by adding it into their. VA funding fee.

Tax service fees. A 1 flat fee charged by the mortgage lender. They range from 5 percent to 36 percent Your funding fee.

The VA fee is a one -time fee payable to the Department of Veterans Affairs. A reader got in touch with us recently to ask a question about the allowable fees and expenses associated with FHA. Simply put a tax service fee is paid to the company that services the loan.

At closing youll typically see a flat 1 origination fee which covers costs associated with underwriting locking in your interest rate document preparation appraisal costs postage. This flat 1 percent fee covers the lenders costs associated with originating processing and underwriting the loan. Veteran must pay a funding fee to VA at loan closing.

Loan for Tax Refund Lenders Available Loan for tax refund - Get your refund much faster and get up to 1000 all without leaving your home or office. The 1 Percent Fee. Many are finding the.

Minimum loan amount is 10000. While most Veterans pay 23 this fee ranges from 05to.

What Is A Va Loan Statement Of Service Rocket Mortgage

Understanding Va Loan Funding Fees Closing Costs Moneygeek Com

Tax Preparation File Taxes Income Tax Filing Liberty Tax Service

Va Loan Closing Costs What Fees Will You Pay Zillow

California Va Fees Costs Va Loans In California Valoansofcalifornia Com

The Different Types Of Va Loans Nextadvisor With Time

Va Loans A Complete Guide To Mortgages Bankrate

Mortgage Costs And Lender Fees You Shouldn T Pay Better Mortgage

Va Loan Calculator Us Department Of Veterans Affairs Morgage Calculator

Va Loan Seller Concessions A Complete Guide Quicken Loans

Va Loans They Re Not The Spawn Of Satan Emily Caryl Ingram

Atlanta Va Home Loans Va Mortgage Hub

Va Guaranteed Home Loans Training Ppt Download

Prepaid Items Mortgage Escrow Account How Much Do They Cost

What Is A Tax Service Fee With Picture

What Is A Va Loan Funding Fee Retirement Living 2021

Va Loans Midland Mortgage Corporation

3 Reasons Why You Should Make A Down Payment On Your Va Loan Supermoney